Ascent Global Logistics is a full service global logistics company providing:

Domestic Freight Management

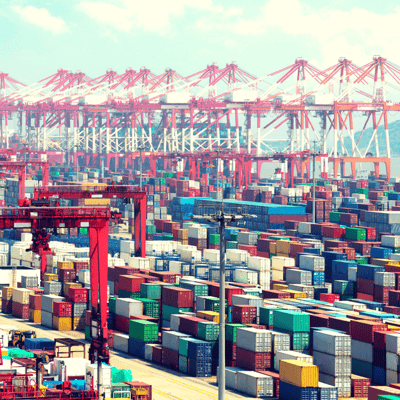

International Freight Forwarding

Retail Consolidation

With a commitment to providing clients with customized logistics solutions, premium customer service, state-of-the-art technology tools and continuous logistics education, Ascent Global Logistics is your partner for peak logistics performance.

Visit www.ascentgl.com for more information.